Is Tech Looking Better? Retail Isn’t; Energy Shows Strength

[ad_1]

Additional Oil Supply from OPEC and Oil Still Moved Higher = Bullish imaginima/E+ via Getty Images

Brian Dress, CFA – Director of Research, Investment Advisor

When we last penned this newsletter, market participants were licking their wounds after seven straight losing weeks. Things certainly looked bleak in a number of sectors, but we were beginning to see small signs that a bottom in technology shares was beginning to form. In the two weeks since the last newsletter, that momentum has grown and we are beginning to gain comfort in the idea that the worst may be behind us in growth tech.

This week we saw pronounced strength in nearly all sectors, most specifically software (iShares Expanded Tech-Software Sector ETF (IGV) was up 6.65% for the week and Consumer Discretionary Select Sector SPDR Fund (XLY) up 6.02% for the week). These most downtrodden sectors appear to have seen quite a bit of fresh buying over the past week, as the market finally begins to digest some positive earnings reports positively, like those from MongoDB (MDB), Okta (OKTA), and SentinelOne (S), among others.

With overall market sentiment finally beginning to improve, we understand the impulse for investors to lean into their optimism and be in a hurry to put money to work again, buoyed by a couple weeks of strong market action. However, even as we pen this letter on Friday morning, we see markets again beginning to backslide, as investors digest the most recent employment report, which on the surface, appeared quite positive.

Inflation remains the sword of Damocles hanging above the head of all investors and good macroeconomic news continues to drive interest rates higher, as we know that the Federal Reserve is explicitly committed to fighting inflationary pressures that permeate the economy. The inflation and interest rate dynamics make us particularly skeptical of recent buying in the consumer discretionary (retail) sector.

Consumers are feeling squeezed by high food and gas prices, decreasing available discretionary income, while retailers themselves are facing profit pressures from the same fuel price spikes, as well as continued supply chain disruptions. Retail stocks have rallied since the negative earnings results from Walmart (WMT) and Target (TGT) two weeks ago, but we continue to look elsewhere for opportunities.

The fiercest selling has indeed appeared to stop, but we think this is still a crucial time for discernment and careful stock picking.

In this week’s newsletter, we will tell you “What’s Working” and “What’s Not Working” as usual, along with two major topics. The first topic we cover will be the reemergence of enterprise tech, which has looked better in the last three weeks as strong earnings reports continue to come in. The second topic we will cover here will be the single sector we have had conviction throughout 2022: energy. Events this week only increase our resolve in that sector, as we posit we may still be in the early stages of a “commodity super cycle.”

With that all being said, let’s get into it!

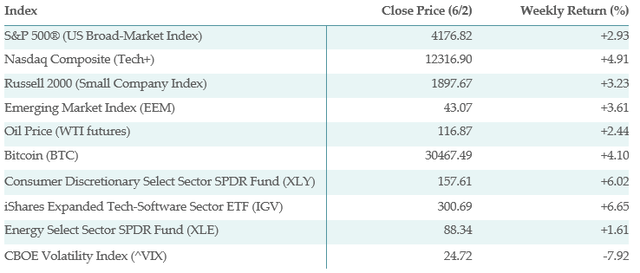

Below is the performance data of key indices, ETFs for the four trading days between 5/26/22 and 6/2/22:

Yahoo Finance, Left Brain

What is/is not Working?

With markets overall strong, you will not be surprised that the traditional “risk-on” segments of the market formed the leadership this week. Software companies around the globe had strength this week. Whether that is from short-covering or fresh buying is hard to determine in the short term, but the improving momentum in computing shares is certainly a positive sign.

Among the strongest ETFs in our watch list this week were KraneShares CSI China Internet ETF (KWEB), EMQQ The Emerging Markets Internet & Ecommerce ETF (EMQQ), First Trust Cloud Computing ETF (SKYY), iShares Expanded Tech-Software Sector ETF (IGV), and Renaissance IPO ETF (IPO), all of which were up by 5.8% or more in this week.

In terms of the sectors that weren’t working this week were ETFMG Alternative Harvest ETF (MJ) and United States Natural Gas Fund, LP (UNG). Many of the “risk off” type ETFs were some of the weakest over the last 4 days of trading, including iShares 20+ Year Treasury Bond ETF (TLT) and iShares TIPS Bond ETF (TIP). We have noted plenty of weakness in the highest quality bonds over the past few weeks, as interest rates continue to rise.

Weakness was also pronounced in the most defensive stock sectors, including iShares US Consumer Staples ETF (IYK) and iShares U.S. Healthcare ETF (IYH).

Finally, we would note that despite the strength in the tech sector over the past week, crypto assets continued to struggle. The Grayscale Ethereum Trust (OTCQX:ETHE) was among our weakest ETFs. We think investors in the crypto space should be concerned that the usual correlation between crypto and tech is breaking down only now when tech is beginning to rally.

Enterprise Tech is Showing Signs

It’s been no secret that technology stocks are having a hard time in 2022. The tech-heavy NASDAQ Composite is currently down more than 24% for the year, firmly in bear market territory (usually a “bear market” is defined by a 20%+ fall from a market’s all-time high). Software stocks are down roughly 25% in the same period. This has all been quite painful for investors. Post-Covid, much of the market’s performance has been driven by a small handful of stocks that operate in the tech space, so many investors have been overweight tech stocks and these investors’ performance has been even worse than the index return suggests.

Fundamentally, business results haven’t changed dramatically for many of these businesses, especially those operating in vital industries that sell to large enterprises: cybersecurity, digital transformation, enterprise software, and other related businesses. Many of these expenditures are mandatory for companies to maintain their operations and should carry some level of recession-resistance.

The trouble for many tech investors has been multiple compression in 2022. Stock prices are a function of two data points: (1) earnings (or profits) and (2) multiple (the amount that investors are willing to pay for each $1 of earnings). One input into the multiple calculation that many investors use is interest rates. Because rates were so low in 2020 and 2021 multiples, especially on tech stocks, were quite high. Moreover, investors in 2022 have shied away from companies with low (or negative) profits, moving instead toward companies with steady cash flows.

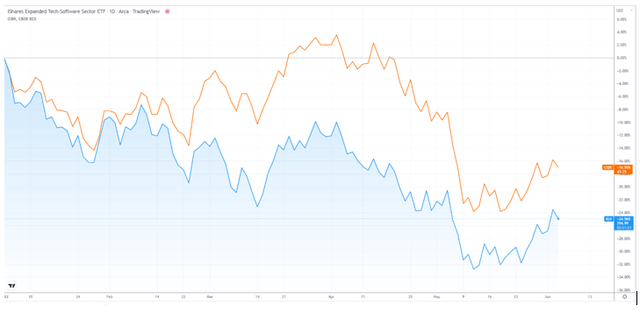

We have started to see things begin to turn in tech over the last few weeks, especially in businesses that sell products and services to business customers. Both the iShares Expanded Tech-Software Sector ETF (IGV) and First Trust NASDAQ Cybersecurity ETF (CIBR) ETFs have had significant up moves from their lows on May 11 of this year. As you can see from the below chart, we are starting to see signs of bottoming in enterprise software:

TradingView

It is also worth nothing from the chart that we had a similar “bottoming” signal in mid-March of this year, so we would caution investors that this could again be a false dawn in shares of this type. We continue to preach that investors should approach tech shares with caution and that buying these stocks a bit higher after there is additional confirmation could potentially create a better risk-reward opportunity, than continuing to bottom fish and “double down” on currently underwater positions.

There were a series of very positive earnings reports coming from enterprise tech this week, many of which resulted in stock price gaps higher. On Wednesday we heard from database leader MongoDB, which reported 82% yearly revenue growth and that the company generated $8.4 million in Free Cash Flow for the quarter. This represents the company’s second straight quarter of positive Free Cash Flow.

The sales growth is certainly impressive, but as we know, investors have been less interested in that in recent times. The positive trajectory of cash flows is what excited investors and the stock jumped by more than 20%. We would note that the tenor has changed in situations like this in the past couple weeks. Early in earnings season, many “beat and raise” earnings reports were greeted with a whimper, which was decidedly not the case for MDB.

Another notable earnings report this week came from Salesforce.com (CRM), which had lost nearly 40% in share value in 2022 prior to this week’s report. This was a company for which investors were desperate to see good news and they received it on Tuesday’s conference call from CEO Marc Benioff. The company reported 24% yearly sales growth and raised expectations for results for the full 2023 (current) fiscal year. Without question, the increased expectations were of a modest nature, but they indicate that Salesforce.com is still driving growth during a period that investors consider very challenging for software businesses.

We also saw positive earnings results from cybersecurity firms like SentinelOne, CrowdStrike Holdings, and Okta, all of which had positive stock price reactions (at least before Friday). Again, we are cautious on sounding any sort of “all-clear” on tech stocks, most of which sit far below all-time highs. A few takeaways for us: (1) we favor tech companies that sell to business customers, as the consumer landscape is fraught, (2) there is still plenty of sales growth in enterprise tech, and (3) companies with steady cash flows and profits seem to offer the best risk-reward scenarios in the current market regime.

Energy Continues to Lead

One of the marks of strength in markets is when “bad” or unfavorable news is unable to translate into negative asset price movements. This week marked a meeting of the Organization of Petroleum Exporting Countries (OPEC), which is a confederation of oil-producing countries that sets oil/gas production quotas for its members in an effort to maximize revenue for the cartel. The so-called OPEC+ also includes non-member nations, such as Russia.

The war in Ukraine and the resulting Western embargo against Russian oil/gas has contributed significantly to higher prices at the pump around the world. The price of crude oil has risen by more than 50% just in 2022, after already substantial price increases in 2021. The main news that came out of the meeting was that the OPEC cartel has agreed to increase overall production by roughly 650,000 barrels per day, in an effort to stem the price increases and make up for the lost production out of Russia.

Most important for investors is the reaction of oil prices in the wake of this news. In the immediate aftermath of the news, the price of West Texas Intermediate Crude Oil (WTI) dropped nearly 5% to just over $111/barrel. However, since early Thursday, the price of oil rallied sharply back to $119/barrel. This tells us that the dynamic is firmly in place that even news that should bring down the price of oil is unable to do so. In our view, this is a very bullish dynamic for oil and oil stocks.

Historically, commodity “super cycles” have lasted for many years. A commodity super cycle is a period when demand for commodities increases, while supply remains constrained. In the wake of the oil price crash of 2014-16, which put many energy companies out of business and put others into extreme distress, most oil/gas firms have changed their approach, electing not to commit large amounts of capital to new exploration. This, along with geopolitical issues and other factors, has constrained supply, putting strong upward pressure on prices.

Oil stocks, as illustrated by the Energy Select Sector SPDR Fund (XLE) were up again this week, despite the OPEC news and XLE is more than 55% higher just in 2022. We think strength in energy may still be in its early innings, given that we stand at the beginning of a potential commodity super cycle. Investors who remain underinvested in energy shares should understand there still may be significant upside here for the rest of 2022.

Takeaways from this Week

We have seen a nice reversal after the market’s spring doldrums of April and May. Most notable has been the strength in enterprise tech companies, particularly those that are generating growth and cash flow. A series of strong earnings reports suggest to us that there may be opportunities worth pursuing in enterprise tech. Though retail had a strong week, we remain skeptical of any rally in that sector, due to inflationary pressures on consumers.

Conviction has been hard to come by in 2022, but we remain confident that energy stocks can continue to perform well for the rest of the year and beyond. The fact that oil prices and energy shares continued their rally, despite news that additional supply is on its way, suggest that we are far from the end of the commodity super cycle.

[ad_2]

Source link