Encouraging a transition in the asset allocation valuation of the limits

Also without relatively high edges, the GOOGL stock can achieve higher P/E tests on the chief executives. Right now, economists forecasting an EPS share of $56.56 for 2021, expect a net pay margin of almost 19 per cent. It’s around halfway from the obvious edge to the actual edge of the year. Right now, GOOG is expecting a profit of 31.8x 2002. I then expect the stock to exchange half of the P/E growth rate with its 2021 share of 38.6 for every cent. That puts its figure at 35.x times its projected earnings in 2021 at $56.56 per percentage, or $1,990.91 per share. Making improvements to the planned edges, GOOG’s price is almost 41 per cent higher in the event that the stock hits the edge and EPS wishes in 2021.

Google is, in particular, one of the most inefficient tech labels in the sector. If you’re using Google to control your messages, look at the web, or whatever else, the company’s dedication may well have been on the radar. Bounce To: Google: Exchange Overview Think and Review How to Purchase Google Stock Offers Counsel and Investigator acquire what you know is an often-repeated enterprise to run the show. In case you’re not used to offer or used to buy common shares, but not alternative investments, here are a few things you’d like to do almost to get bargains from either the Look turbocharger.

Significant Analysis

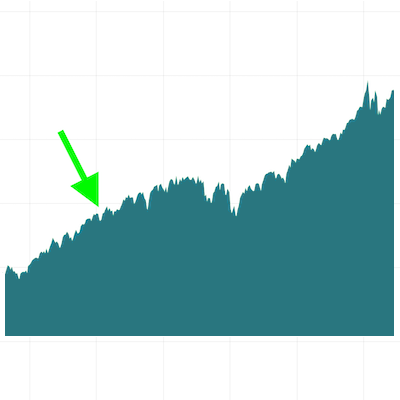

Everything else that you need to be careful of is trying to schedule an ad. The scheduling of a notice involves receiving or delivering a bid at the optimal time for the most important earnings. Usually GOOGL stock the difficulty that the store exhibit is uncommon, except for better days on the way. Uses are especially relevant when a number of companies charge a price of between $4 and $10 per exchange. Looking at Google’s share expense over the fair last five a long time, you’ll see a steady upward trend. However, there have been times when sales and profits have fallen sharply.

Skillful rebound the advanced description reveals Letter Set bargains dropping to a professional back of around $1,170. In the event that the stock continues to be kept to the volume of specialized funding, it may provide assistance in refueling the rise to $1,271. Typically another degree of resistance has progressed. That’s going to be an improvement of almost 8 per cent from the actual cost of nearly $1,180. Expanded Taken a toll Targets Spectators, on the other hand, see bargains rising higher than the usual target of more than $1,385. The expense target has improved by more than 16% from the beginning of the year when it was around $1,187.Before investing, you can check its cash flow at https://www.webull.com/cash-flow/nasdaq-googl.